Bitcoin - 2014 - 2018 Comparison Part 1

Bitcoin’s 2018 correction has an uncanny resemblance to the 2014 correction. Bitcoin currently broke down through the .618 fib level for the second time. If 2018 correction continues to follow the 2014 correction path, it will retrace to .618 level, but will get rejected and head lower. Is bitcoin’s price action predictable? I would say if humans are, then yes. Since price action is a direct reflection of fear and greed, it is likely we’ll see a replay of 2014. In 2018 bitcoin is progressing much faster in it’s correction, 3x faster than 2014.

Comparison

Here is the 2014 rise and correction. The rise to just over 1k was meteoric, much more exponential than the one we saw in 2017. What took 2 months to reach a climax, took 1 year for the calm down.

On 9/18/2014 broke the .618, retraced, then a sell-off.

On 3/29/2018 bitcoin broke the .618 and is currently trying very hard to recover. As did in 2014, it probably will retrace and retest the .618 level and fail. It is possible that it will break above it and reach an all time high in the next month or two. But I think it is more probable that it will go through the same painful corrective path.

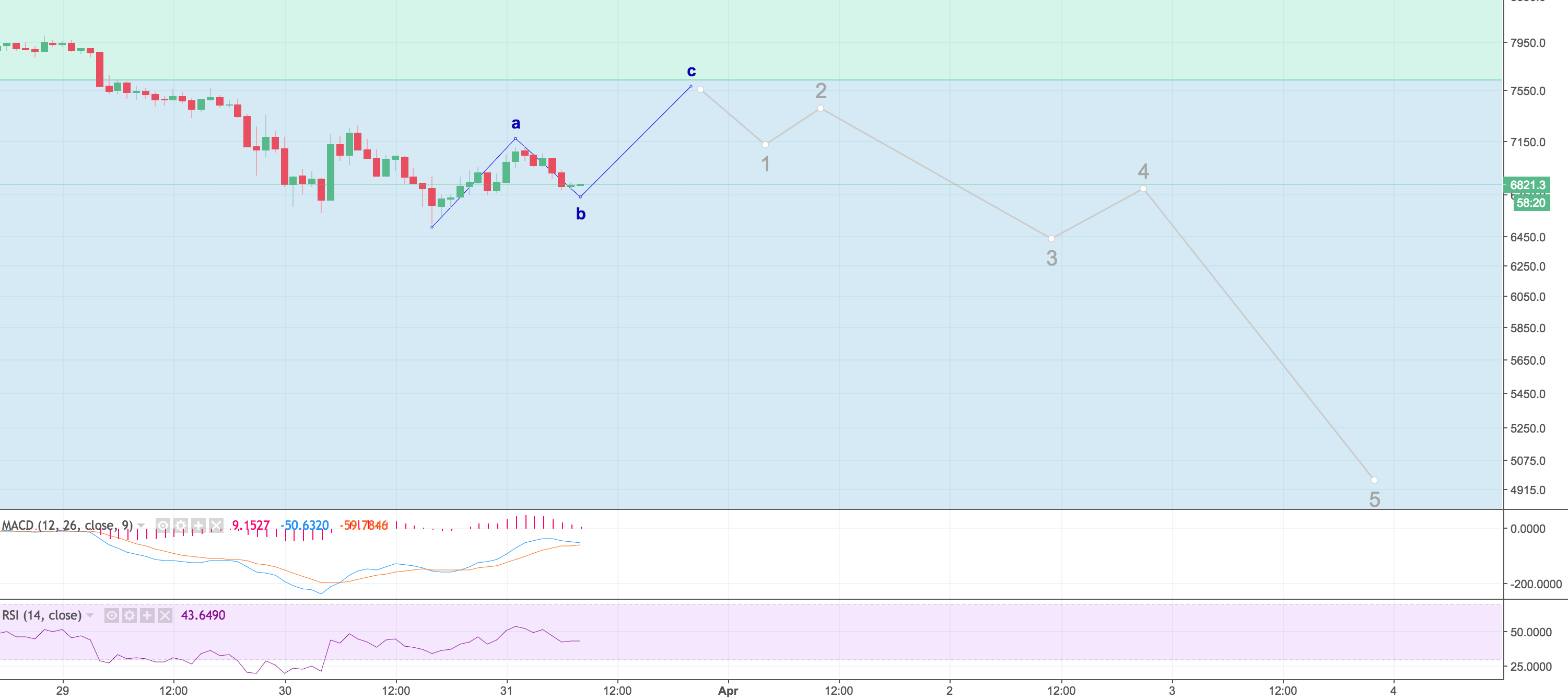

Closer Look

2014 bitcoin 4 hour chart shows the retrace and a sharp decline with an extended wave 5.

2018 bitcoin 1 hour chart shows following the same path, and we may see 5k price in less than a week.

Stock Market

The stock market is also poised to make a significant decline taking a very similar path as bitcoin.

Birth of a new Monetary System

Is bitcoin dying? No, on the contrary. It is merely going through the stages of birth. It is a long and painful process, but a necessary one to make sure a well developed baby is born. Bitcoin will set the foundation for a new monetary system and hopefully it will pave the road to the next chapter in the social and technological evolution of the human race.

*Legal Disclaimer: I am not a financial advisor nor is any content in this article presented as financial advice. The information provided in this blog post and any other posts that I make and any accompanying material is for informational purposes only. It shoud not be considered financial or investment advice of any kind. One should consult with a financial or investment professional to determine what may be best for your individual needs. It’s only meant for use as informative or entertainment purposes.